Czech: An Overview of the Czech Economy

2011/09/12

An Overview of the Czech Economy

Major macroeconomic indicators

| 2007 | 2008 | 2009 | |

| Population (million of inhabitants) | 10.3 | 10.4 | 10.5 |

| Gross domestic product (US$ billion) | 174 | 217 | 190 |

| Real GDP growth (%) | 6.1 | 2.5 | -4.1 |

| Consumer prices (year-on-year % change) | 2.8 | 6.3 | 1.0 |

| Exports of goods (US$ billion) | 122.8 | 146.4 | 112.9 |

| Imports of goods (US$ billion) | 118.5 | 142.2 | 104.9 |

| Average exchange rate (Czech koruna per US dollar) | 20.3 | 17.0 | 19.1 |

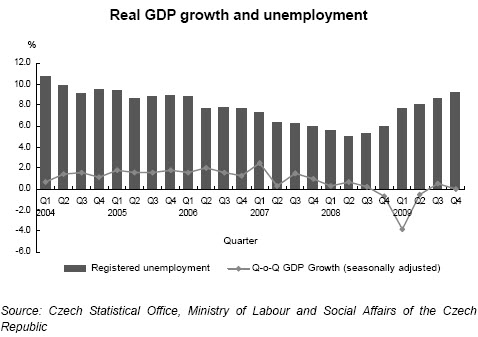

The Czech Republic, with a small population of 10.5 million inhabitants, is not immune to the aftershocks of the global economic crisis. In particular, being a major auto and electronics exporter in the region, the slump in demand for automobiles and industrial machinery/equipment across Europe has had a direct bearing on the Czech economy, leading to two consecutive quarters of GDP declines starting Q4 2008. Nevertheless, despite being battered hard by the global economic crisis, the Czech Republic has been one of the best performing economies in Central and Eastern Europe (CEE), with GDP growth resuming since the second quarter of 2009. Although it is still not sufficient to turn red GDP figures into black for the whole of 2009, and that high unemployment and fiscal deficit will continue to drag on consumer and investor spending, the budding recovery of the overall European economy and the subsequent rebound in export demand for automobiles, thanks largely to the proliferation of “cash-for-clunkers” programmes in Europe, has gradually put the Czech economy back on growth track. Following various upward revisions, the Czech economy, which is estimated to have shrunk by 4.1% in 2009, is forecast to pick up pace to 1.4% growth in 2010.

Together with an average GDP growth of 5% over 2003-08 and a per-capita income increase from 73% to 80% of the EU average, Czech's sound economic fundamentals such as healthy trade balances have largely helped the country to weather the global financial crisis and stand out among peers such as Hungary and Ukraine. Be that as it may, the Czech local market will take time to rise back to pre-crisis levels, and the external market can hardly fully recover until the haze of a new round of financial crisis beset by toxic mortgage-based and consumer assets in the CEE region really comes to an end. New-to-the-market Hong Kong companies should therefore adopt a more long-sighted approach when developing the Czech market.

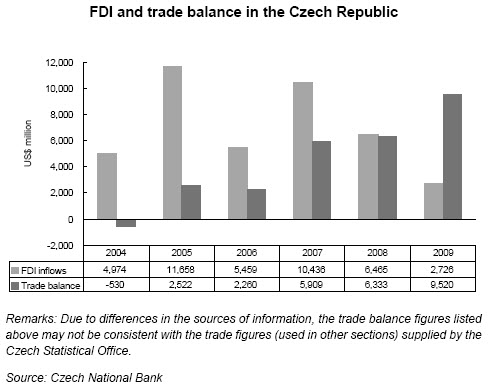

Looking at the increasing trade surpluses and FDI inflows, few will deny that Czech's integration into the EU is undoubtedly an important driving force behind the country's strong economic growth in recent years. Outsourcing, both manufacturing and R&D, from Western and Nordic Europe, has been quickly gaining popularity in the post-EU accession era in the Czech Republic, thanks to the abundance of skilled labour and the relatively low cost of production.

The Czech Republic, being one of the most popular foreign direct investment (FDI) destinations in the CEE region, has not only benefited from the ever-growing incoming foreign capital, technology and know-how, but also the enhanced export capacities, job creation and income growth. While both FDI and trade are still suffering from the economic slowdown, the Czech Republic, given its central location in Europe and the unstoppable tide of orders shortening the length and complexity of the supply chain, will remain attractive for European and international outsourcers after the crisis.

- Related Articles

-

Czech Republic Infrastructure 2012

2012/05/19 更多 -

IMF Executive Board Concludes 2011 Article IV Consultation with Czech Republic

2011/10/31 IMF Executive Board Concludes 2011 Article IV Consultation with Czech Republic On April 4, 2011 the Executive Board of the IMF concluded the Article IV consultation with the Czech Republic, and considered and endorsed the staff appraisal without a meeting. -

Czech Republic Oil and Gas Report Q4 2010

2011/09/19 Czech Republic Oil and Gas Report Q4 2010 -

IMF Data & Forecasts

2011/08/10 2010 2015 Scale Units GDP at constant prices 2973.04 3501.32 Billions -

Czech Waste Profile 2011

2011/07/06 Waste (Czech Republic) Why should we care about this issue Hazardous waste production, the Czech Republic [thousands of tonnes]

-

- Czech News

-

- AFGHANISTAN: UNWTO: International tourism – strongest half-year results since 2010

- ALBANIA: US LNG exports make European market more competitive

- CZECH: Investors spooked by Property Regulations in Africa

- CHINA: China, Czech Republic pledge to jointly enrich strategic partnership

- CZECH: Czech government to resign in row over finance minister's business dealings

- AFGHANISTAN: Higher earning Why a university degree is worth more in some countries than others

- Trending Articles

-

- SOUTH AFRICA: Nigeria and South Africa emerge from recession

- BAHRAIN: Bahrain issues new rules to encourage fintech growth

- ANGOLA: Angola: Elections / 2017 - Provisional Data Point Out Qualified Majority for MPLA

- WORLD: How fair is our food? Big companies take reins on sourcing schemes

- CHINA: Russian firm seals energy exploration deal to drill South African shelf

- NIGERIA: Nigeria has been one of the hardest-hit economies due to its over-dependence on oil