United States: President Trump’s plan to dramatically cut taxes on businesses and individuals

2017/04/28

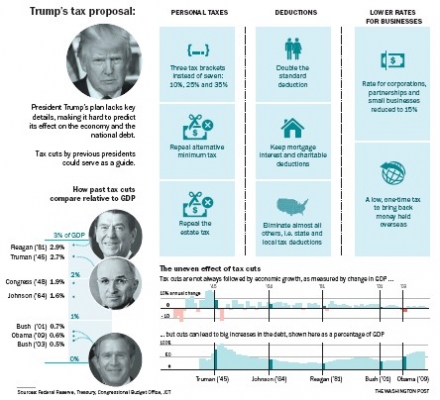

At the center of President Trump’s plan to dramatically cut taxes on businesses and individuals is a promise to stimulate extraordinary economic growth, so much so, his advisers say, that the plan will pay for itself.

If he succeeds in keeping that promise, Trump will have accomplished something that his taxcutting Republican predecessors failed to do, according to economists and tax policy experts from both parties.

In describing the proposal Wednesday, Trump’s top economic advisers said the plan would unleash new investment and spending by American companies and consumers, supercharging economic growth. That growth, in turn, would prevent the plan from leaving the federal government short trillions of dollars of tax revenue.

But in the experience of two other Republican presidents, Ronald Reagan and George W. Bush, tax cuts produced an uneven record on prompting economic growth. And in both instances, reductions in taxes failed to pay for themselves and instead left the nation to deal with increasing federal debt.

After his 1981 tax cut, Reagan was forced to raise taxes several times. And Bush’s tax cuts put the nation on vulnerable fiscal footing, depriving the government of revenue as the United States waged two wars and faced a financial crisis. Ultimately, Congress and President Barack Obama, after several standoffs over federal finances, increased taxes by billions of dollars and imposed strict limits on government spending.

Economists fear it will happen again. “This is definitely not in pays-for-itself territory,” Alan Cole, an economist at theconservative Tax Foundation, said of Trump’s plan.

At the White House on Wednesday, Trump’s advisers touted the cuts as the start of an economic renaissance, recommitting to promises that their proposed tax regimen would both grow the economy and cut the debt.

“This tax reform package is about growing the economy, creating jobs. It’s about the economy,” Gary Cohn, director of Trump’s National Economic Council, told reporters. “That’s how we’re looking at this plan.”

Treasury Secretary Steven Mnuchin said the plan would curb the debt. “The economic plan under Trump will grow the economy and will create massive amounts of revenues, trillions of dollars in additional revenues,” Mnuchin said.

Trump’s tax guidelines diverge from an effort by congressional Republicans, led by House Speaker Paul D. Ryan (R-Wis.), to craft a plan that aims to cut rates while keeping the government’s total tax revenue level, as the reductions would be balanced out by new taxes elsewhere and the elimination of loopholes.

For Trump, the attraction of his strategy is that it allows his administration to avoid proposing massive spending cuts or offsetting tax increases to keep the debt in check. And indeed, even the modest proposals he is making to raise some offsetting funding — such as limiting tax deductions to offset state and local taxes — promise to be controversial as he attempts to enlist Congress in support of his plans.

But while Trump says his tax plan is part of a broader agenda that will validate his campaign promises of economic growth not seen for decades, economists remain skeptical.

After reviewing the tax policy outline that the Trump administration released Wednesday, several said they are hopeful that Republicans can craft a plan that would have modest benefits for the economy, but few expected Trump to be able to deliver the level of growth he has promised.

“The evidence shows clearly that no feasible tax reform in this country will raise economic growth to 3 percent on a sustained basis, given our current demographics,” said Doug Elmendorf, former director of the Congressional Budget Office.

As Trump attempts to succeed where Reagan stumbled, he will deal with multiple hurdles the former president didn’t, argued Douglas Holtz-Eakin, a conservative economist and former adviser in the Bush White House.

When Reagan reduced rates, he cut the maximum marginal rate on ordinary income for individual taxpayers from 70 percent to 50 percent.

That rate currently sits at 39.6 percent, and cutting it further is unlikely to have the same on-theground impact on taxpayers’ decisions.

“Further reductions in rates are “just not going to have as big an impact as some of those early, dramatic fixes did,” Holtz-Eakin said.

Reagan, Elmendorf said, benefited from women’s entry into the workforce, which accelerated economic growth. Now, as the baby-boomer generation hits retirement, the labor force is shrinking, limiting the prospects for the economy.

Trump also comes into office facing far more debt. According to the Congressional Budget Office, the U.S. public debt is the equivalent of 77 percent of gross domestic product, a level that’s more than double the rate faced by Bush or Reagan. That worries fiscal conservatives.

“I don’t want to run some fiscal-policy experiment with the largest, most important economy on the planet. I mean, we’re not Belgium,” said James Pethokoukis, an economic commentator at the conservative American Enterprise Institute. “I would urge caution.”

Trump will be attempting to cut taxes in a more difficult environment than prevailed for either Bush or Reagan, but even those two presidents’ policies had mixed results. Economists debate how successful they were in stimulating the economy, but nearly all agree that the cuts ultimately added to the debt, as they failed to pay for themselves.

During the Bush administration, two rounds of large-scale tax cuts, first in 2001 and then in 2003, were followed by an economy that stagnated and then cratered amid the financial crisis of 2008. The economy grew at an average rate of 2.1 percent annually during his eight years in office, though there were external factors — including the Sept. 11, 2001, terrorist attacks and the ensuing economic aftershock.

Reagan experienced far more economic success. When he cut rates in 1981, the economy was beginning to recover from a tumultuous decade of unemployment and inflation. By 1984, however, the GDP expanded at an annual rate of 7.3 percent in 1984, an extraordinary figure. The expansion continued for the remainder of Reagan’s term, but in no year since 1984 has the growth in GDP reached even 5 percent annually.

Economists, however, debate how much of the boom was the result of Reagan’s tax policies and how much was the result of the actions of the Federal Reserve and other economic forces outside of the president’s direct control.

Reagan’s policies marked an inflection in the national debt, which had been declining rapidly and was near 25 percent of GDP when Reagan took office. The debt reached 39 percent of GDP by the end of his presidency — in part a consequence of increased spending on the military.

Despite recent history, members of Trump’s camp say Trump will deliver on his promises.

“When you think about that cutting that corporate rate, let’s say, from 35 to 15, that’s not going to cost you any money,” said Arthur Laffer, a former adviser to Trump’s campaign and economist and among the most prominent advocates of reducing rates. “There are not going to be any revenue losses there.”

“This isn’t going to be easy. Doing big things never is,” Cohn said Wednesday. “We will be attacked from the left and attacked from the right, but one this is certain: I would never, ever bet against this president. He will get this done for the American people.”

Outside of his circle, however, Trump faces skepticism. Democrats are already lining up against the plan. While Ryan on Wednesday praised Trump’s plan as a positive step, George Callas, the speaker’s senior counsel for tax issues, warned against a temporary reduction in the corporate rate that would increase borrowing.

“It would not alter business decisions. It would not cause anyone to build a factory,” Callas said last week. “It would just be dropping cash out of helicopters on corporate headquarters for a couple of years.”

- Related Articles

-

Is the TPP a sleeping beauty or an organ donor?

2017/06/27 Will the work that went into negotiating the Trans-Pacific Partnership (TPP) go to waste? There are two approaches the remaining members can take. Useful parts of the TPP can be uplifted and transplanted into other agreements. Or the trade agreement can be seen as a sleeping beauty — or better from presently on, a modern woman who needs no prince but who will wake up and get on with it. The TPP cannot be revived as drafted. The agreement cannot come into force unless ratified within two years by economies that constitute 85 % of the total GDP of the 12 members. This makes ratification by the United States and Japan indispensable. While President Trump is not noted for consistency of purpose, the prospect that he will not only reverse his stance on the TPP but as well fasten Congressional approval within two years is surely nil. -

The next chapter for the Trans-Pacific Partnership

2017/06/27 The next of trade and cross border commerce in Asia and the Pacific and the US role in Asia’s economy were put in doubt by Donald Trump’s withdrawal of the United States from the Trans-Pacific Partnership (TPP) economic agreement. The TPP was the economic arm of President Obama’s pivot to Asia. It was as well supposed to set the rules and standards of trade in Asia and for the world. It is no amaze again, that some of the remaining 11 members of the TPP are trying to save the agreement even without US participation. A lot of political capital was expended in negotiating the TPP and nations are looking for ways to maintain the momentum of economic integration. -

Here’s a forecast that should worry investors betting on a second-half surge in the economy

2017/06/20 Investors betting on a strong pickup in economic increase may want to consider a new estimate hitting Wall Street on Monday. The New York Federal Reserve presently expects U.S. economic increase at an annualized rate of 1.9 % for the second quarter, down from a 2.3 % estimate. The bank as well expects annualized increase of 1.5 % in the third quarter, down from 1.8 %. -

US companies interested in investment opportunities in Jordan Forum highlights projects in Jordan, region

2017/06/02 Planning and International Cooperation Minister Imad Fakhoury said several US companies want to tap investment opportunities available in the country and expand their investments, according to a ministry statement released on Tuesday. The minister gave the remark in his address at the inauguration ceremony of the Jordanian-US Business Forum on Monday as he deputised for Prime Minister Hani Mulki. US companies want to learn about new opportunities in the Kingdom and they as well want to participate in reconstruction projects in the nations of the region, while being based in the Kingdom, the minister told the attendees, stressing the importance of the Jordan-US partnership. -

US Healthcare Inefficiency: Evidence From International Prescription Drug Data

2017/05/29 Despite higher per capita healthcare spending, US health outcomes compare poorly with other developed nations. One potential reason is that the US healthcare system creates incentives that promote the faster adoption of medical technologies with minimal benefits. This column tests this claim using data on the quality and diffusion of new pharmaceuticals in the US and four other nations. The results suggest that compared to Australia, Canada, Switzerland, and the UK, low-quality drugs diffuse additional quickly in the US relative to high-quality drugs.

-

- United States News

-

- CANADA: Is the TPP a sleeping beauty or an organ donor?

- BRUNEI : The next chapter for the Trans-Pacific Partnership

- UNITED STATES: Here’s a forecast that should worry investors betting on a second-half surge in the economy

- JORDAN: US companies interested in investment opportunities in Jordan Forum highlights projects in Jordan, region

- UNITED STATES: US Healthcare Inefficiency: Evidence From International Prescription Drug Data

- BAHRAIN: Policy Differences Emerge Among Gulf States Days After Wooing President Trump

- Trending Articles

-

- LIBYA: Libya unity forces take control of Tripoli airport

- PAPUA NEW GUINEA: Papua New Guinea taps renewables and gas to satisfy growing energy demand

- BRUNEI : The next chapter for the Trans-Pacific Partnership

- CHINA: Hong Kong SAR, Australia announce official launch of FTA negotiation

- JAPAN: Retirement Age Should Be Raised To 70, Says World Economic Forum

- BULGARIA: Bulgarian commissioner fields easy questions at MEP hearing