Lebanon: Lebanon Economy Profile

2015/09/06

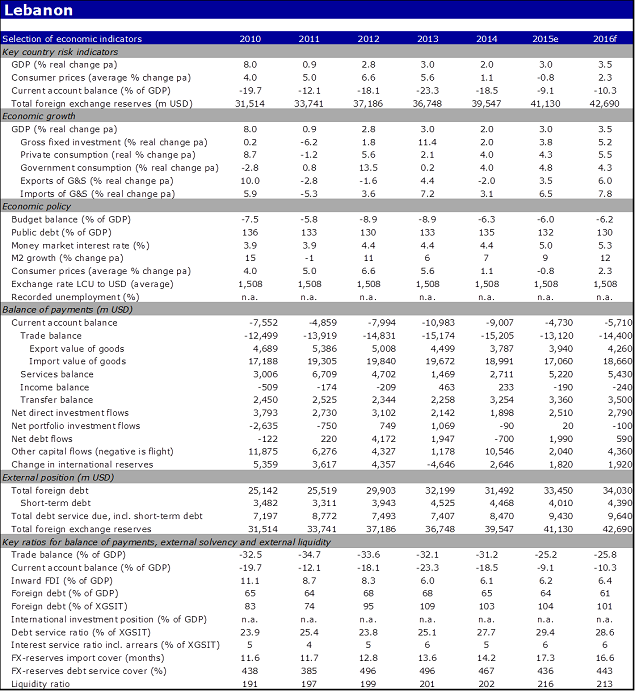

Lebanon’s economy continues to show weak increase in 2014 (3%), being adversely effected by the conflict in Syria. Furthermore, Syrian refugees have put pressure on public finances and may further increase unemployment. But the banking sector remains healthy and Lebanon still has ample foreign reserves, which mitigates Lebanon’s otherwise high country risk.

Strengths (+) and weaknesses (-)

(+) Structurally strong remittance inflows

Lebanon’s vast diaspora has sent home remittances worth 20% of GDP each year for over a decade, making this a strong pillar of the economy.

(+) Strong banking sector

Lebanon’s banking sector is sophisticated, well regulated and enjoys a solid depositor base, as the country is seen as a safe haven in the Middle East.

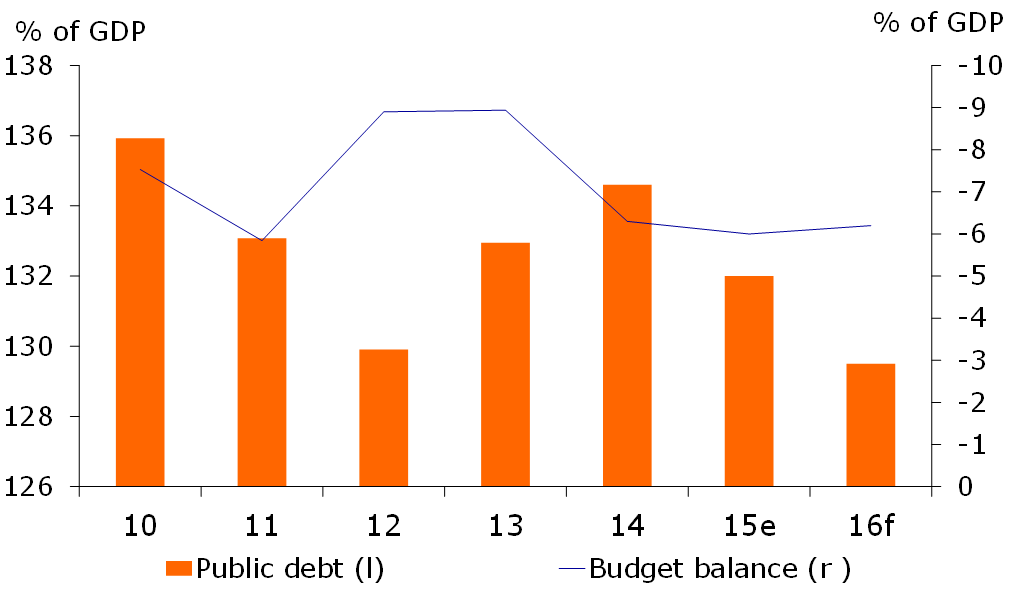

(-) Weak fiscal position

Lebanon’s weak fiscal position is characterized by a high level of public deficit and continuous budget deficits.

(-) Unstable domestic politics

Coalitions fall frequently in Lebanon and their short-lived nature has led to an absence of significant structural reforms in years.

Key developments

1. Economic increase remains sluggish amidst Syrian conflict

Due to the prolonged conflict in its neighbour Syria, Lebanon’s GDP continues to suffer. GDP increase eased to 2% in 2014, compare to 3% in 2013. On a positive note, private consumption has increased (Figure 1), partially due to lower oil prices since oil accounts for almost a quarter of Lebanon’s total imports. However, the result of lower oil prices has been offset by the decline in external request, which again partially relates to Syria since it is Lebanon’s fifth major export market and has suffered a severe economic contraction since the start of the civil war in 2011. Syrian GDP for example declined by 22% and 25% in 2012 and 2013 respectively. From an extra perspective, exports as well declined since prices of precious metals (16% of exports in 2014) have gone down. Gold and platinum for example have declined by 6% and 24% in the completed year.

Importantly, tourism as well continues to suffer, while this is and traditionally has been an significant sector for the economy. Namely, the tourism sector accounts for about a quarter of Lebanese GDP, and as well accounts for about a quarter of employment. Tourism is suffering because of an increased perception of risk in Lebanon. Hotel occupancy rates for example are currently hovering around 50%, while they were around 70% in 2009 and tourist arrivals have decreased 7% in 2013, next by presently having decreased 12% in 2012.

2. Adverse effects of Syrian refugees

The number of Syrian refugees in Lebanon has reached about 1.5m, and presently constitutes about a third of Lebanon’s people. This influx of refugees has three adverse effects. Initial, it puts strain on the government’s public finances, which are by presently completely weak (Figure 2) with a budget deficit of 6% of GDP and public deficit steadily increasing from 130% of GDP to 135% of GDP in 2014. The World Bank recently estimated that the in general fiscal impact of the Syria crisis over the period 2012-2014 was a cumulative USD 2.6bn, which represents about 5% of 2014 GDP. Going forward, refugees will likely continue to put pressure on government finances, for example because the huge increase in people strains public infrastructure.

Second, it increases the people of low skilled workers in Lebanon, in an by presently weak labour market. Around 60% of the Syrian refugees work can be classified as low-skilled and according to the IMF, the influx of Syrian refugees has increased labour supply by about 50%, mostly effecting opportunities for unskilled workers, youth and women. This influx of labour could potentially increase unemployment to 20%, according to the IMF.

But even besides the added problem of Syrian workers, Lebanon needs to reform its labour market. Currently, there is a mismatch between the high quality of Lebanon’s (private) universities and high skill jobs. As a consequence, well-educated workers have historically emigrated to other nations (brain drain), which reduces potential economic output as human capital leaves the country.

Third, it has the potential to create social tensions between the Lebanese and Syrians. Syrian refugees for example are willing to accept much lower wages than Lebanese workers, which could create the perception that Syrians are “steeling jobs” from the Lebanese. For presently, we think this result will not likely lead to major problems, but the mix for civil unrest (high unemployment and influx of foreigners) is there.

Figure 1: GDP growth still weak

3. Banking sector remains healthy and foreign reserves remain high

Despite all economic and political problems Lebanon is facing, it’s banking sector is remarkably healthy. Banks are well capitalised, with Tier 1 ratios around 12% and have moderate Non Performing Loan ratios of about 4%. Moreover, the banking sector has shown resilience in the completed, for example during the war with Israel in 2006. This stable banking sector is driven by a steady increase (about 8% per year) of foreign deposits, which have over the years grown to a sizable reserve of foreign currency. Lebanon has foreign reserves worth USD 39bn and gold reserves of about USD 11bn, totalling USD50, or about 100% of its GDP.

Figure 2: Fiscal position still weak

Thus, although Lebanon’s public deficit is very high (135% of GDP), it is backed by ample foreign reserves. Financial markets currently do not view this high deficit as a major risk, indicated for example by Lebanon’s continuing success in issuing foreign currency bonds to finance its deficit. However, the high deficit makes government expenses inflexible, as interest payments account for about 30% of government expenses. This inflexibility is a risk going forward.

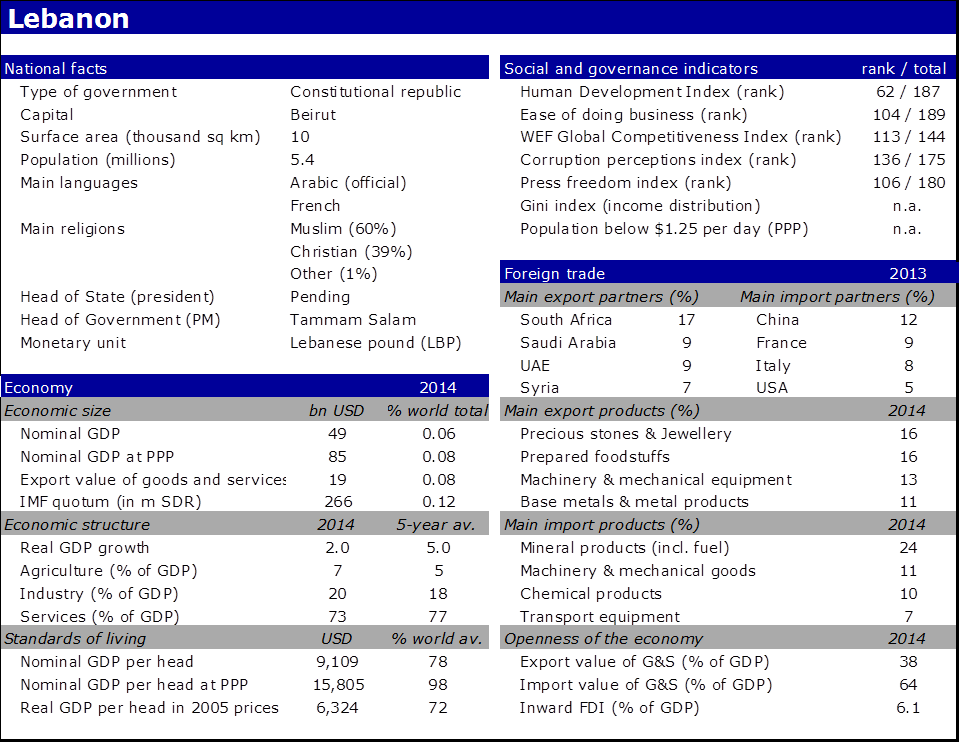

Factsheet of Lebanon

Background information

Lebanon’s nominal GDP per capita of USD 9,109 is moderate, but the country enjoys large remittances from Lebanese abroad. These remittances of the often highly educated émigrés de facto form the country’s major export category. In a regional perspective, educational levels are high. Lebanon’s universities are reputed for their quality and Beirut is the ‘hospital’ for the wealthy in the Middle East. The economy is led by the services sector with 73% of GDP (2014), of which banking is he most noticeable. Tourism, particularly from the Gulf States and Europe, is an extra driving sector of the services-based economy. Lebanon has developed into a multi-religious country over the centuries. Since 1860, each of the leading (sub-) denominations of Muslims and Christians are guaranteed a representation in the executive, legislative and administrative powers. The civil war ended in 1990 next it was agreed that the seats in parliament are divided between Christian (seven groups; 40% of people) and Muslim (four groups with 60% of people) members, with each group occupying half of the seats in parliament. The president, the prime minister and the speaker of the parliament have since been a Maronite Christian, a Sunnite and a Shiite respectively. Power blocs are often temporary coalitions of clan leaders, additional based on confessional and local interests or on personal/family relations than on political or ideological views. In this extraordinary political complexity, coalitions are rarely lasting, which causes slow - or deadlocked - decision making on critical issues.

Economic indicators of Lebanon

- Lebanon News

-

- LEBANON: Dr Alain Hakim, Minister of Economy and Trade

- LEBANON: Lebanon cabinet meets under pressure from trash demos

- LEBANON: Ecotourism attract visitors to Lebanon,Lebanese people to discover their own country

- BAHRAIN: The 6th Ministerial Meeting of the China-Arab Cooperation Forum to be Held in Beijing

- BAHRAIN: Saudi king, most Gulf leaders to skip landmark US summit

- LEBANON: Switzerland to Unfreeze $827 Million in Libyan Assets

- Trending Articles

-

- CHINA: Morocco and China sign $1.54bn currency swap agreement

- TANZANIA: Tanzania Breweries now partners with traditional liquor outlet owners

- BOTSWANA: Routes Africa forum aims to improve African air connectivity

- KENYA: Kenya's tea industry moves toward strategic diversification

- CHILE: Chile Student Protests 2016: Police Arrest 117, Use Tear Gas During Education Reform Demonstration

- TURKEY: Why is Mr Erdogan spending so much time in Africa?

.gif?1338940414)